The Zebra’s annual report reveals that car insurance premiums are the highest on record, volatile, and reactive to changes in technology and human behavior.

AUSTIN, Texas, Feb. 11, 2019 /PRNewswire/ — The Zebra, the nation’s leading car insurance search engine, today released its 2019 State of Auto Insurance Report, which reveals that car insurance rates have risen for four out of five American drivers (83%) over the past year. In fact, rates across the U.S. are higher than they’ve ever been — up 23% since 2011 with an average annual cost of $1,470.

The Zebra’s annual report examines more than 61 million auto insurance rates across every U.S. zip code to provide insight into the many factors insurance companies use to price insurance — and how that pricing is unique to every individual.

“Some people are paying $500 a year while others are paying $5,000. Why? It could be weather in your state, your driving habits, or even your gender, marital status, or credit score,” says Alyssa Connolly, Director of Market Insights, The Zebra. “Car insurance is a major expense for most Americans, and drivers want to know how much their rates are changing — especially as new technology comes into play.”

Key findings reveal that the state of auto insurance in 2019 is:

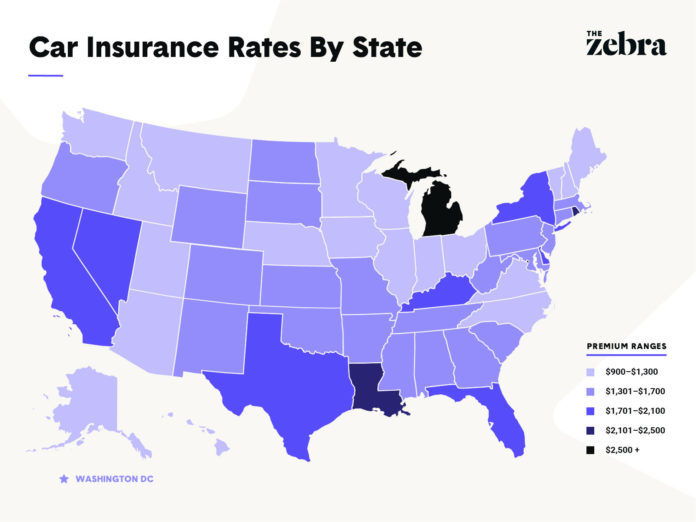

Expensive — Car insurance rates are higher than ever, with some parts of the country paying upwards of $5,000 per year.

- Most expensive states:

- Michigan: $2,693

- Louisiana: $2,339

- Rhode Island: $2,110

- Most expensive cities:

- Detroit, MI: $5,464

- New Orleans, LA: $3,686

- Hialeah, FL: $2,997

Erratic — Rates vary dramatically, with massive increases (and some decreases) over time, and vast disparity even within a single state.

- In Colorado, car insurance costs are up 80% since 2011, but they’re down 20% in Oklahoma in the same time frame.

- Rate changes from year to year have been as high as 45% in some states.

- Even within a state, rates can vary from one zip code to another by as much as 265%.

Evolving — In 2019, technology is changing both how people drive and how car insurance companies operate.

- Insurance companies are using telematics (apps or plug-in devices to monitor a driver’s behavior), which has the potential to lower costs for safe drivers and provide extensive data about driving trends.

- Distracted drivers are starting to pay the price for their dangerous behaviors with an average insurance rate penalty of 20%.

- Although new technology is making cars safer, it’s also making them more expensive to repair or replace, so drivers likely won’t see any car insurance savings for these new car features.

- Car insurance companies are already leveraging insights from consumers’ online behavior for marketing and other purposes, and there is potential this data could inform how they price rates in the future.

See the 2019 State of Auto Insurance Report to explore how gender, credit score, age, popular cars, teen drivers, and all rating factors affect insurance costs by state.

In another study provided by Zebra, they suggest that your online behavior may also affect what you pay for car insurance. Zebra investigates potential massive threat to consumer privacy: how big data is revolutionizing the insurance industry and what that might cost consumers in real dollars.

The car insurance search engine released findings of an investigative report that explores whether the U.S. auto insurance industry — which serves 250 million U.S. drivers — is collecting and using data about consumers’ online behaviors and preferences (their “digital footprints”) to calculate what people pay for their car insurance policies.

How People Behave Online Could Affect Their Car Insurance Bills by Hundreds of Dollars

The Zebra’s report explores how 35 “digital footprint” preferences or behaviors could serve as risk indicators, and how those factors could affect someone’s auto insurance premium in real dollars. For example:

- Android owners could pay $32 more while iPhone owners might pay $70 extra each year.

- Gmail users might pay an additional $100while AOL users save the same amount.

- People online at 9:00 a.m. might see savings of $17, while those online at 3:00 a.m. could pay an additional $58 in premium.

Insurance companies have the technical ability to track online activity — whether by interacting with consumers online, via in-car devices that monitor driving, or by purchasing data. In fact, insurers are already tracking consumers’ online activity for purposes other than setting rates, such as fraud detection, claims processing, and marketing.

“Industries around the world are leveraging big data to their advantage — whether they’re lenders in the U.S. considering a user’s web browser before offering a loan or they’re European insurers using people’s email addresses to price rates. So, we asked ourselves, ‘Is this happening in the U.S. auto insurance market today? What might that look like?'” says Alyssa Connolly, The Zebra’s Director of Market Insights. “Someone’s behavior online generates mountains of data that can help companies learn about consumers — the question is: does that help or hurt consumers?”

Consumers: Unfair for Insurers to Use Digital Footprint Info!

The Zebra conducted a nationwide survey, asking consumers to consider whether 30 data points would be fair for insurance companies to use for pricing their policies (underwriting).

- Approximately 60% of consumers said they consider the use of every digital footprint factor — things like their web browser activity, their typing habits, and even their private social media activity — that could conceivably be used to price auto insurance as “unfair.”

- 71% of respondents are not OK with insurers tracking their behavior even if they were guaranteed to save money.

- More people said it was fair to use a person’s race (which is currently illegal) in underwriting than any of the digital footprint factors.

Benefits and Drawbacks of Big Data in Insurance Underwriting

The insurance industry is being reshaped by technology. Big data can improve accuracy and stability in underwriting, reduce consumer costs, and support the 11% of people with little to no credit history, who may be younger or in underserved communities.

Potential drawbacks of leveraging this data for insurance underwriting include the argument that these factors are unfairly discriminatory and irrelevant. Some people are skeptical of the unproven technology, and worry that consumer privacy could be jeopardized. Ultimately, state regulators will be responsible for determining if digital footprint factors are fair for insurers to use.

For the full in-depth report featuring data analysis, consumer survey results, and methodology, please visit https://www.TheZebra.com/research/digital-footprint-car-insurance/.

About The Zebra

The Zebra is the nation’s leading auto insurance search engine. With its dynamic, real-time quote comparison tool, drivers can identify insurance companies with the coverage, service level, and pricing to suit their unique needs. The Zebra compares more than 200 car insurance companies and provides agent support and educational resources to ensure drivers are equipped to make the most informed decisions about their car insurance. Headquartered in Austin, Texas, The Zebra has sought to bring transparency and simplicity to insurance shopping since 2012 — it’s “insurance in black and white.”

SOURCE The Zebra

Related Links