Can Cold Weather Make You A Better Financial Planner – Northern States Have The Winning Scores

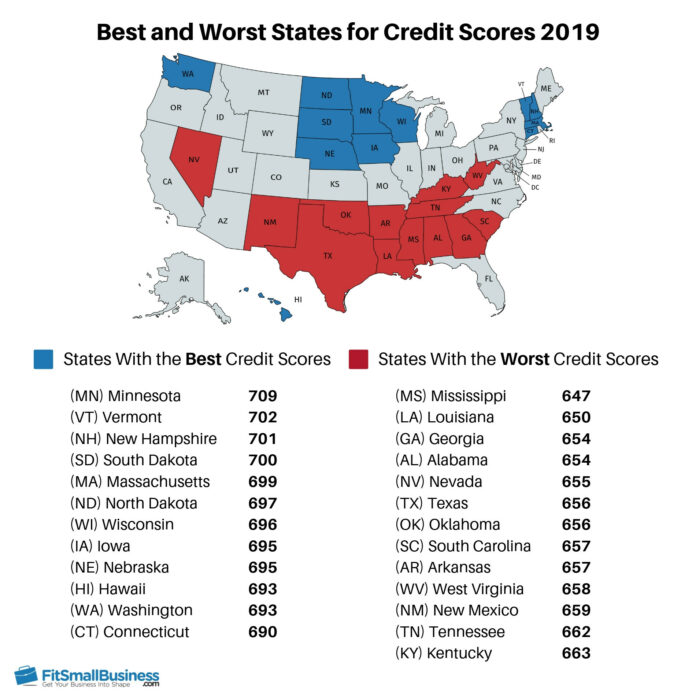

NEW YORK, June 12, 2019 /PRNewswire/ — Having a good credit score is a sign of good financial health. We all know that reducing your debt, and not spending beyond what you can afford can help increase your credit score. But, here’s a surprise: good credit scores are not evenly distributed across the U.S.

As a general rule, the average credit score is higher in northern states than the average credit score in southern states.

Editors at FitSmallBusiness.com, the digital business publication, wanted to find out why this is so. The quality of education tends to be higher in the North, which results in more responsible decision-making, and often, higher incomes. Southerners tend to suffer from bad personal credit due to poorly ranked educational systems and a heavy dependence on government aid. Southerners also tend to have higher bankruptcy filing rates than northerners. These intriguing correlations prompted the editors to analyze other location-specific factors that might affect credit scores. Writers and editors researched financial, social, personal and environmental factors for each state.

You’ll find the entire report HERE.

THE BEST AND WORST STATES FOR CREDIT SCORES FOR 2019

The 12 Best

|

#1 Minnesota |

Credit Score: 709 |

|

#2 Vermont |

Credit Score: 702 |

|

#3 New Hampshire |

Credit Score: 701 |

|

#4 South Dakota |

Credit Score: 700 |

|

#5 Massachusetts |

Credit Score: 699 |

|

#6 North Dakota |

Credit Score: 697 |

|

#7 Wisconsin |

Credit Score: 696 |

|

#8 Iowa |

Credit Score: 695 |

|

#9 Nebraska |

Credit Score: 695 |

|

#10 Hawaii |

Credit Score: 693 |

|

#11 Washington |

Credit Score: 693 |

|

#12 Connecticut |

Credit Score: 690 |

The 12 Worst

|

#38 Kentucky |

Credit Score: 663 |

|

#39 Tennessee |

Credit Score: 662 |

|

#40 New Mexico |

Credit Score: 659 |

|

#41 West Virginia |

Credit Score: 658 |

|

#42 Arkansas |

Credit Score: 657 |

|

#43 South Carolina |

Credit Score: 657 |

|

#44 Oklahoma |

Credit Score: 656 |

|

#45 Texas |

Credit Score: 656 |

|

#46 Nevada |

Credit Score: 655 |

|

#47 Georgia |

Credit Score: 654 |

|

#48 Alabama |

Credit Score: 654 |

|

#49 Louisiana |

Credit Score: 650 |

|

#50 Mississippi |

Credit Score: 647 |

FitSmallBusiness editors used these weighted baseline metrics to factor into their analysis:

- Cost of Living (10 percent)

- Median Household Income (10 percent)

- Quality of public education (10 percent)

- Percent of residents with a bachelor’s degree (10 percent)

- Unemployment rates (10 percent)

- Average debt per person (10 percent)

- Bankruptcies per 100,000 residents (10 percent)

- Median age of residents (10 percent)

- State spending on public assistance (10 percent)

- Marital status (10 percent)

“None of this means that any individual northerner is more credit worthy than any individual southerner,” says Sarah Wright-Killinger, Managing Editor, FitSmallBusiness. She added: “But, it is interesting to see how credit scores and location correlate.”

SOURCE FitSmallBusiness.com